PayPal has transformed the way we manage money online. Whether you’re shopping, sending money to mates, or operating a business, PayPal delivers a fast and suitable medium for monetary dealings. This manual will stroll you through everything you need to know about creating and using a PayPal account efficiently. By the end, you’ll be equipped with all the elements necessary to confidently guide the features and benefits of your new PayPal account. So, let’s start and learn how to create a PayPal account step-by-step.

What is PayPal?

PayPal is a digital revenue forum that lets users send and receive money online. Established in 1998, PayPal quickly became a leader in the online price enterprise. Today, it works in over 200 nations and helps multiple money, making it a go-to global commerce option.

Why You Need a PayPal Account

A PayPal account is essential for modern financial transactions. It delivers exceptional comfort and security for online shopping and lets you invest without transferring monetary details. To take advantage of these advantages, you must open a PayPal account and become familiar with its features. PayPal also provides a fast and dependable solution for shipping money to friends and family.

Also, businesses can help from PayPal’s seamless integration with e-commerce platforms, which permits easy payment processing and efficient cash release control. Whether you’re a person or a business owner, including a PayPal account allows monetary dealings and enhances your online knowledge.

-

Benefits for Individuals

For people, PayPal offers a seamless way to shop online, send cash to friends and home, and even pay for service. Online retailers widely get it, and it delivers an additional coating of security by keeping your financial data secret.

-

Benefits for Businesses

Businesses benefit from PayPal’s easy integration with e-commerce media, quick entry to funds, and tools for invoicing and search payments. It’s an important tool for any company looking to grow its online existence.

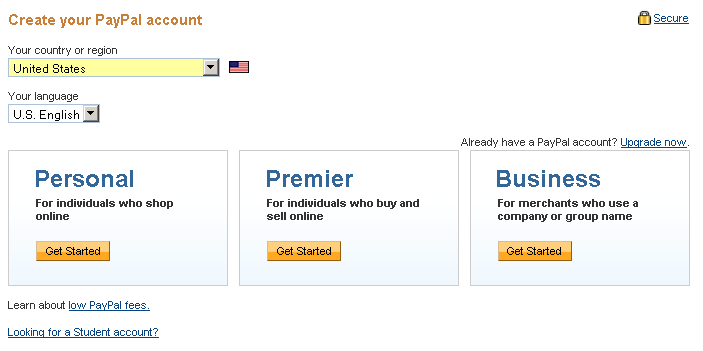

Types of PayPal Accounts

PayPal offers several account types to feed different needs. Personal accounts are perfect for shopping online or sending cash to friends. Business accounts deliver advanced components for vendors, such as payment processing and invoicing tools.

Though less common, Premier versions offer improved characteristics for users requiring more than a basic understanding. Each type is created to facilitate financial dealings in its unique way.

-

Personal Accounts

A Personal PayPal account is ideal for people who shop online or send money to friends and family. It’s easy to set up and offers all the necessary features.

-

Business Accounts

A Business PayPal account offers more features tailored to retailers, such as the power to accept fees under a business name and key to PayPal’s business tools.

-

Premier Accounts

While not as common as Personal or Business reports, Premier accounts to cater to users who require more than necessary features but don’t need all the functionalities of a Business account.

Requirements to Create a PayPal Account

To create a PayPal account, you need:

- A valid email address

- A phone number

- A bank account or credit card

- A secure internet connection

Step-by-Step Guide to Creating a PayPal Account

-

Accessing the PayPal Website

Sure, here is a unique instruction:

Go to the official website. Tap on the “Sign Up” button in the upper corner.

-

Choosing the Type of Account

You’ll be prompted to choose between a Private or Business account. Choose the one that nicely fits your needs.

-

Providing Personal Information

For added security, when you log in, you must enter the code texted to your phone and your password to start two-factor verification (2FA).

-

Verifying Your Email Address

PayPal will mail a validation email to the lesson you delivered. Open this email and click the link within to verify your account.

-

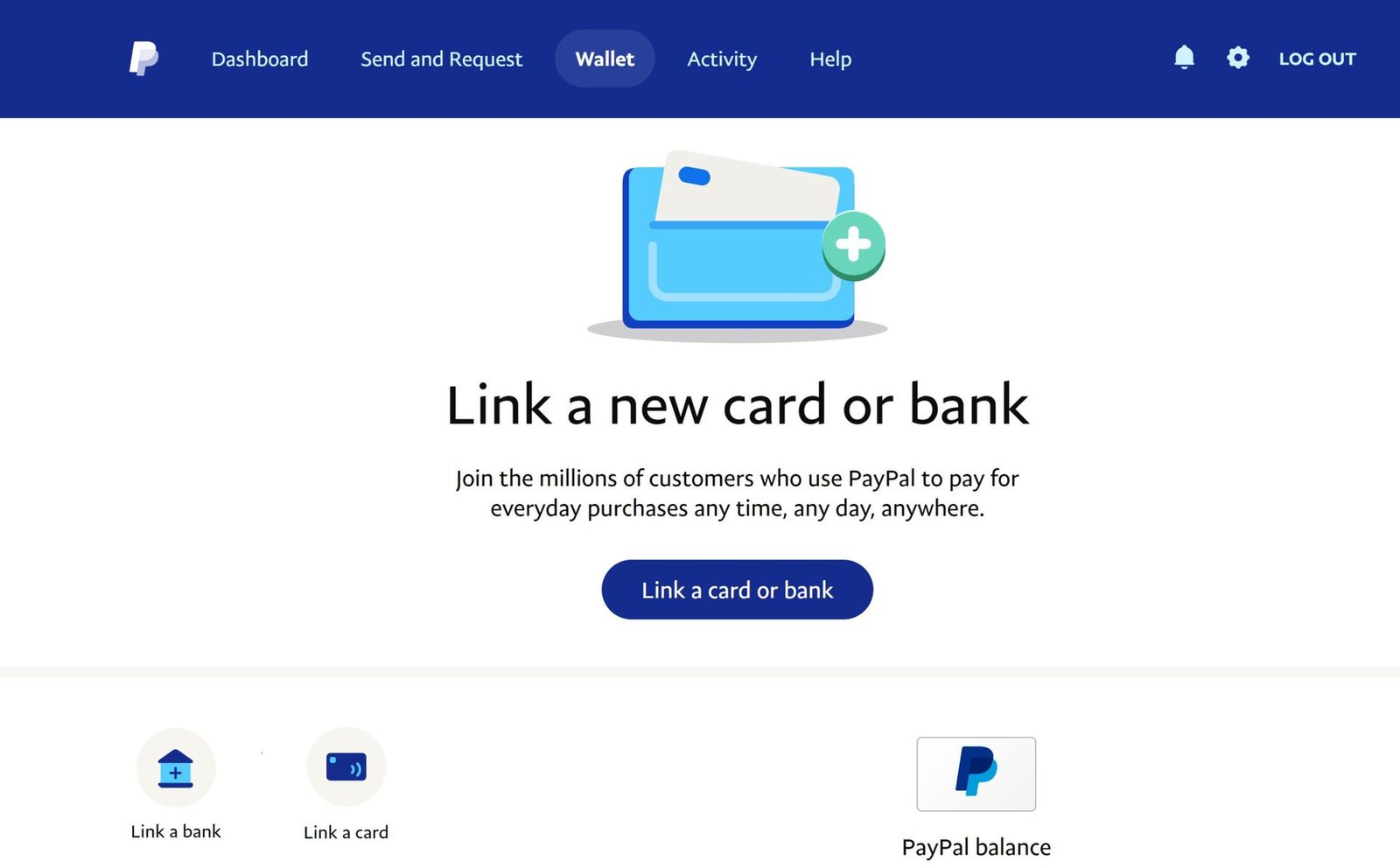

Linking a Bank Account or Credit Card

To verify your company history and allow transactions, you’ll need to add a bank account or credit card, just like you would with a personal PayPal account.

Setting Up Security Measures

-

Choosing a Strong Password

Select a strong, memorable password for your PayPal account. Bypass using readily guessable passwords like “123456” or “password.”

-

Enabling Two-Factor Authentication

For extra security, when you log in, you must enter the code texted to your phone and your password to activate two-factor authentication (2FA).

-

Recognizing exploit Attempts

Be wary of phishing attempts. PayPal will never email you your password or financial information. Always log in directly through the PayPal website.

-

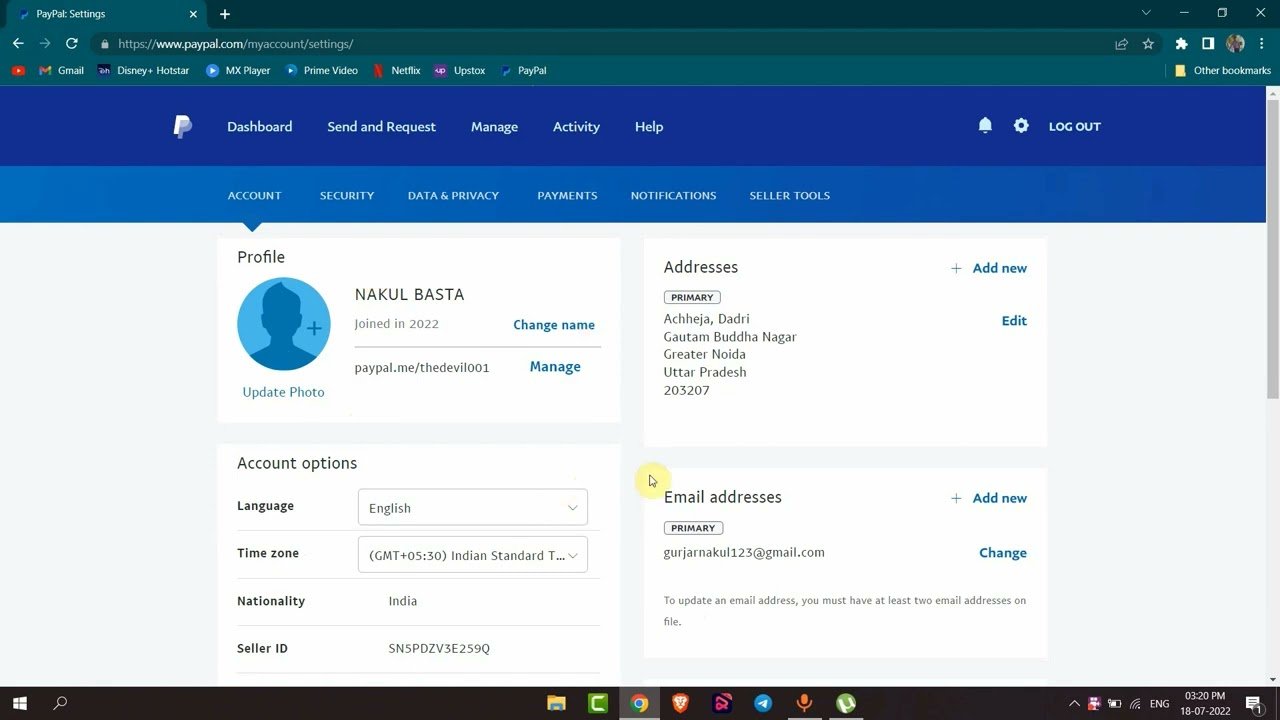

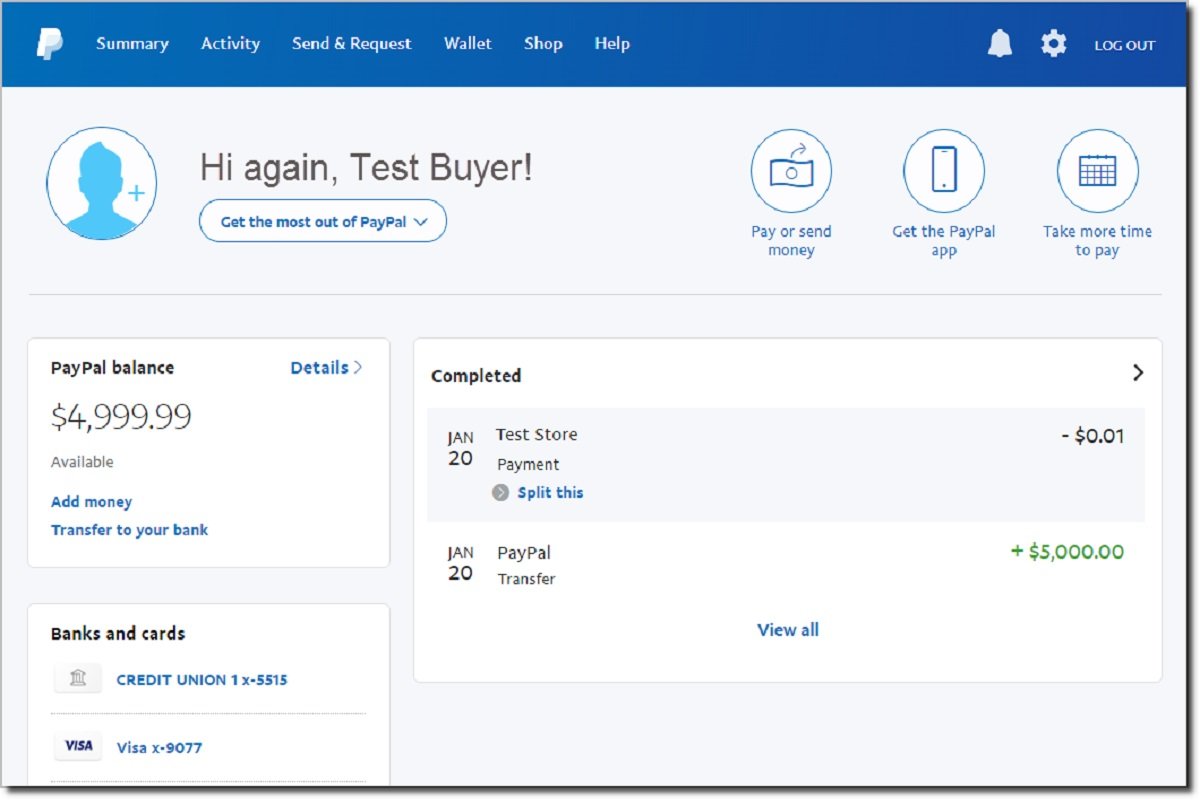

Navigating the PayPal Dashboard

Once your account is set up, take some time to educate yourself about the PayPal dashboard. You can view your credit and transaction history here and access different tools and parts.

-

Why It’s Important

Counting your bank account or credit card is needed to confirm your identity and make transactions.

-

How to Link Accounts

Guide to the “Wallet” area of your dashboard and select “Link a credit card” or “Link a bank account.” Follow the education to complete the procedure.

Troubleshooting Common Issues

If you encounter problems connecting your accounts, ensure your card or bank statement is accurate and that you have a dedicated internet link.

Sending and Obtaining Money with PayPal

PayPal reduces shipping and receiving money globally. Users can move funds to friends, family, or businesses with just a few clicks. Whether breaking a bill, spending for benefits or accepting payments, PayPal delivers a fast and suitable platform.

With elements like instant transfers and buyer security, PayPal provides smooth and worry-free transactions for all its users, promoting trust and dependability worldwide.

-

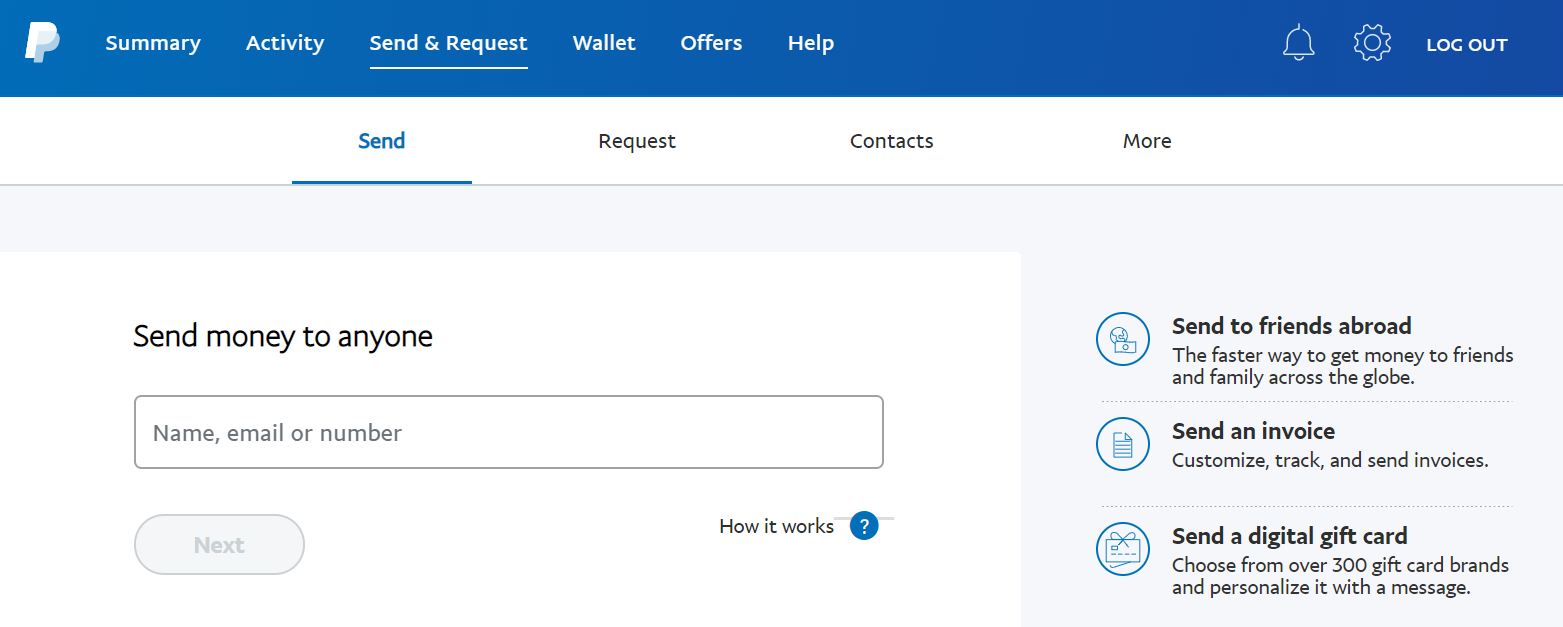

How to Send Money

To send money:

- Tap on the “Send & Request” tab.

- Input the amount, the beneficiary’s phone number or email address, and a message if selected.

- Confirm the details and click “Send.”

How to Request Money

To request money:

- Click on the “Request” tab.

- Input the beneficiary’s phone number or email address jointly with the bid quantity of cash.

- Send the request, and PayPal will notify the recipient.

Understanding Fees

Sending money to friends and family within the exact country is usually free if your PayPal credit or bank account supports it. However, fees may apply for global commerce or using a credit card.

-

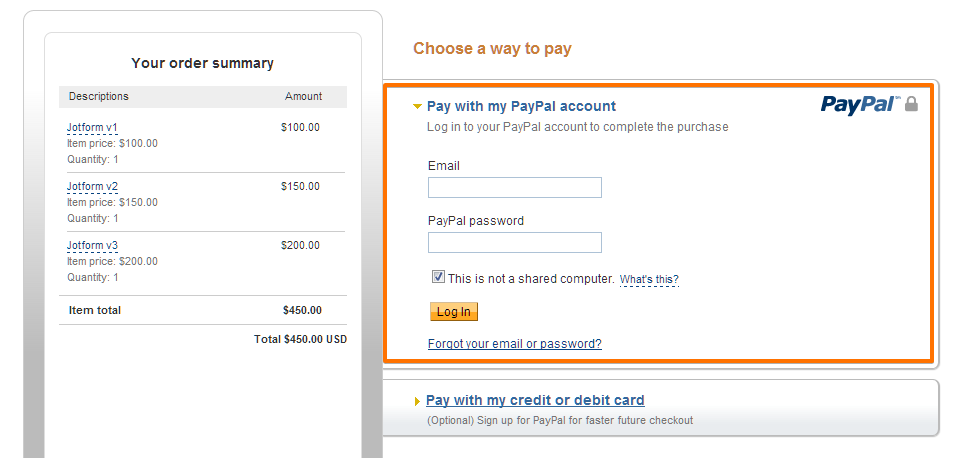

Using PayPal for Online Shopping

Using PayPal for online shopping has an extra layer of protection. You don’t have to share your financial facts with the seller, and PayPal also offers consumer protection for eligible assets.

-

How to Check Out with PayPal

When shopping online, look for the PayPal button at checkout. Click on it, log into your PayPal account, and confirm the payment details.

International Transactions with PayPal

PayPal enables seamless international commerce, allowing users to send and obtain money across borders easily. Whether delivering freelancers abroad or buying goods from global retailers, PayPal efficiently converts money.

Users can rest assured knowing their trades are secure and covered. With fine fees and competitive exchange rates, PayPal makes navigating global commerce straightforward, licensing people and businesses to join and succeed worldwide.

-

Sending Money Abroad

PayPal makes it easy to send money internationally. Enter the beneficiary’s email address and the payment, and PayPal will convert the funds.

-

Currency Conversion Fees

Be aware that PayPal charges a fee for currency conversions. Before international transactions, check the current rates and fees on the PayPal website.

PayPal for Businesses

-

Setting Up a Business Account

Select the “Business” option to create a business PayPal account during sign-up. Equip your company details and link a bank statement to accept payments.

-

PayPal’s Business Tools

PayPal offers different business tools, including bill, expense search, and integration with e-commerce outlets. These tools can help simplify your processes and improve cash flow.

PayPal Fees and How to Minimize Them

PayPal charges fees for specific trades, such as receiving payments for goods and benefits or making international transfers.

-

Tips to Reduce Fees

Use a PayPal credit or a connected bank account to minimize fees. Negotiating lower fees with PayPal based on your transaction volume can also help businesses.

Conclusion

Creating a PayPal account is a specific process that extends a world of options for handling your finances online. Whether looking for a safe way to shop or a business aiming for efficient cost solutions, PayPal offers a universal and trustworthy platform. Follow the steps summarized in this manual to create a PayPal account and start appreciating its benefits today.

FAQs

Does a free PayPal account exist?

Is PayPal available in Pakistan?

Can I have multiple PayPal accounts?

How can I withdraw money from PayPal?

Are there any alternatives to PayPal?